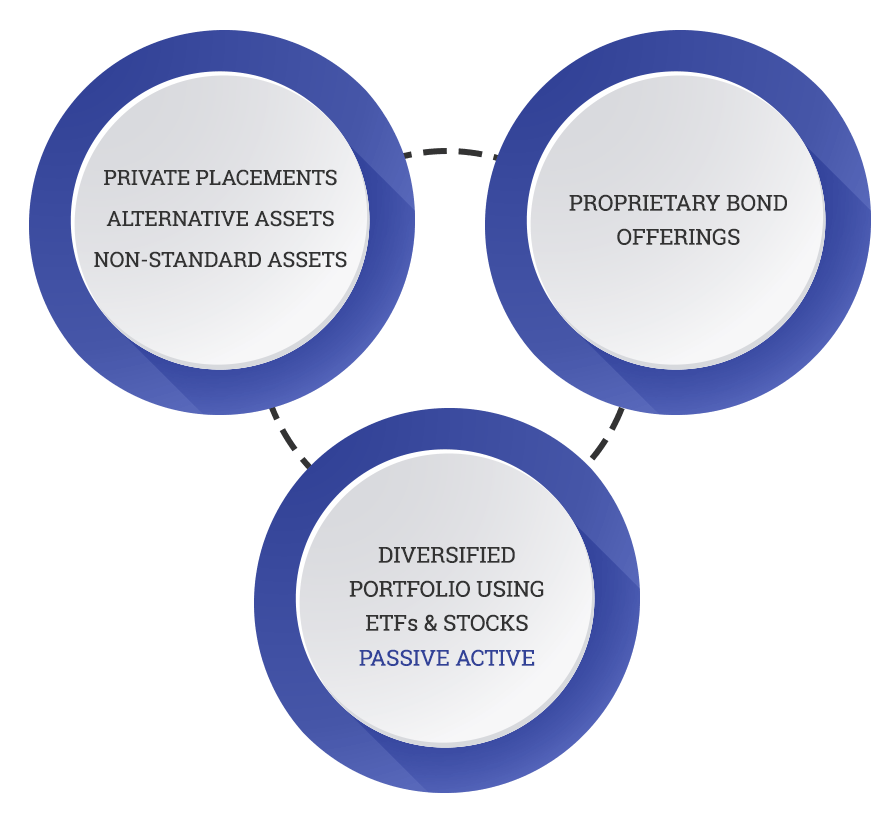

PROPRIETARY INVESTMENT APPROACH

Our goal at Tryon Investments, LLC is to cater to the expectations of the High Net Worth (HNW) and Ultra High Net Worth (UHNW) investor(s). Typically, these clients seek higher returns, which usually have higher risk, with lower exposure to the traditional stock/bond market. Most Private Placements have very strict criteria for investors and require participants to be accredited investors and meet suitability standards. Investing involves risk including the potential loss of principal. Some of our investment access is available to non-accredited investors, as well.

The term “accredited investors” is defined by the U.S. Securities and Exchange Commission (SEC) as individuals with a net worth (not including a primary residence) in excess of $1 million, or individuals with a gross income of at least $200,000 ($300,000 for joint income with a spouse) for each of the two last years. The individual must have the expectation that the same level of income will continue in the current year.

Securities Offered through Cabin Securities, Inc. Member FINRA/SIPC

“Only What’s Best for Clients” – No Cost Services

- Portfolio Analysis Review (PAR report) – 2nd set-of-eyes

- Social Security Maximization Report – shows all available options

- Retirement Analyzer – financial planning

CMC Models (audited each year, 16+ year history)

- Conservative Bond ETF

- Dividend Income ETF

- Balanced ETF (40/60 stock/bond)

- Conservative Growth ETF (60/40 stock/bond)

- Growth ETF (80/20 stock/bond)

- Capital Appreciation ETF (98/2 stock/bond)